We all love to save a buck where we can. One of those ridiculously overlooked areas is in foreign exchange, or in simple terms, transferring money overseas.

Let’s say you need to pay for something online which isn’t billed in your native currency, i.e. for some service, a module, plugin, software, hotel booking and all those little things.

The typical business owner would either use their native bank’s foreign exchange service or something like PayPal right? Well, not necessarily, because like anything out there you should be an informed consumer that doesn’t accept anything at face value.

There are plenty of options and I hope the below can help you save the next time you have to send money across the border. Of course, you can’t send money abroad for free. Every bank and foreign currency exchange firm has its own set of fees and charges.

Unless you know the rules, you could be paying a lot more in fees and ultimately sending a lot less of your money. So, with that in mind, here are a few providers I tried, some cost-saving tips, and security considerations to know before you transfer money overseas.

MoneyGram is a trusted provider, so if ever you are uncertain and want some assurances, this would be a good choice as they are well known with a solid track record. However its not cheap. Sending a $1000 AUS dollars to the USA will cost you $65 AUS. This is steep if you compare it to other providers out there.

I have to admit this one was my personal favorite. Their website is so user friendly and they have this neat little tool that helps you calculate how much money you can send, what the exchange rate will be, how much the recipient will receive and what your fees would be.

I found the rate to be fair and they guarantee it for up to 48 hours so there is no rush. Their handling fee was also super low. For $1000 AUS dollars it came to less than USD 6 in fees. Not bad at all.

Providers like OFX is a smart way to do a non-bank money transfer if you look at their fees and the competitiveness of their exchange rates.

Their fees are between $0 USD up to $15 USD. In certain instances, they will sometimes waive any fees for amounts over $10 000 USD, so always check before you do it as it may change.

This was also a really good contender. Their conversion rates were good and the fees were USD 5 to send $1000 AUS to the United States. Also got to be one of my top two.

As I’ve said before with MoneyGram, if you want a long standing and trusted brand, then this is it. Western Union gives a reasonable exchange rate and charges USD 10 to send AUD 1000 to the USA. Consider this the middle ground if ever there was one for money transfer providers out there.

For amounts less than USD 1000 , PayPal would be a far cheaper option than using your local bank to do the transfer. The exchange rates could be perceived to be less favorable, because they don’t charge you a handling fee that local banks would charge and that can be anything from USD 18 to about USD 32.

This is a difficult one, as not everyone trusts or understands how it works.

If your recipient is fairly comfortable with something like Bitcoin then go for it, but keep in mind that the volatility of Bitcoin over the last 12 months makes this a very speculative and risky option.

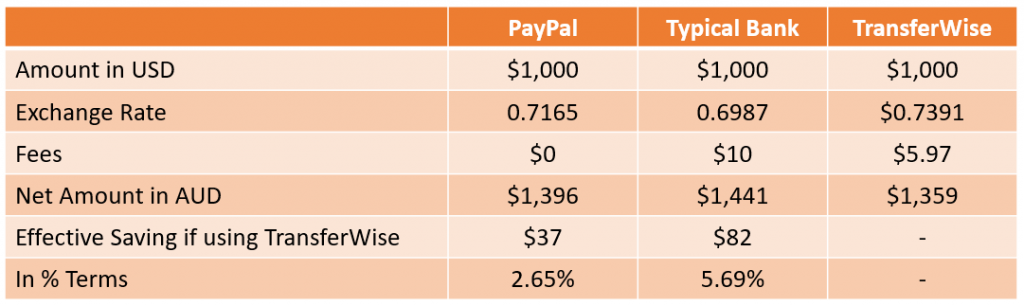

Let me show you what that looks like in actual costs, when comparing the fees involved with a couple of money transfer providers out there. In this example, we will transfer a USD 1000 from Australia.

As you can see, there is an enormous saving in percentage terms. Let’s say you spent USD 1000 a week, it will equate to over USD 4,000 in savings per year. Keeping your finger on who offers what when transferring money overseas can really add up. Just think what you can do with that kind money.

We live in a modern world where there is always someone out there trying to scam you or trick you. Always make sure that when you transfer money, try and consider these very simple but critical best practices:

I PROMISE this is the only Email Sign up box I use, there is no silly catches, it’s a very simple notification style email that will simply notify you when I post more Mistakes I Made or How I Make Sales or Advice That Did Nothing for Me.

No Spam, No Junk. Unsubscribe Anytime. Promise.